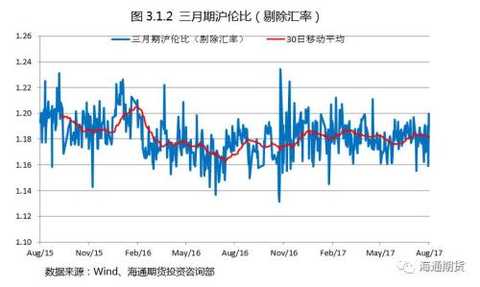

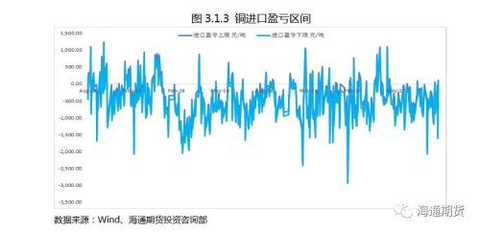

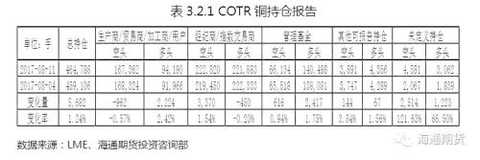

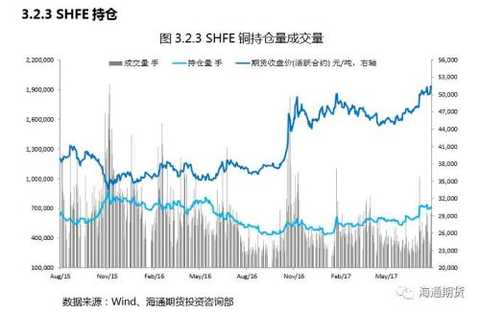

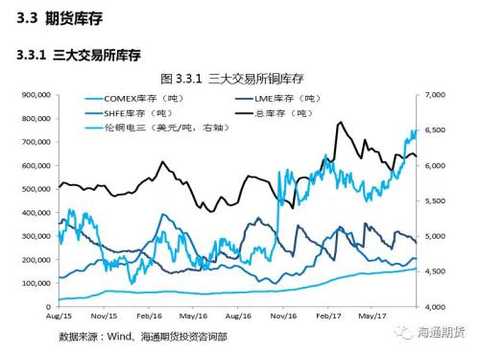

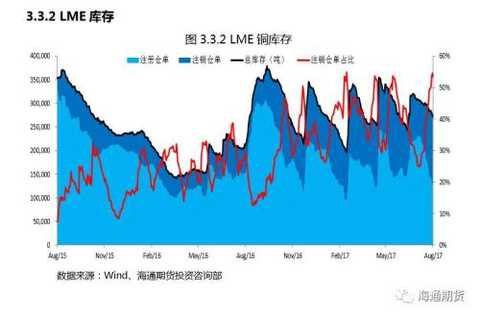

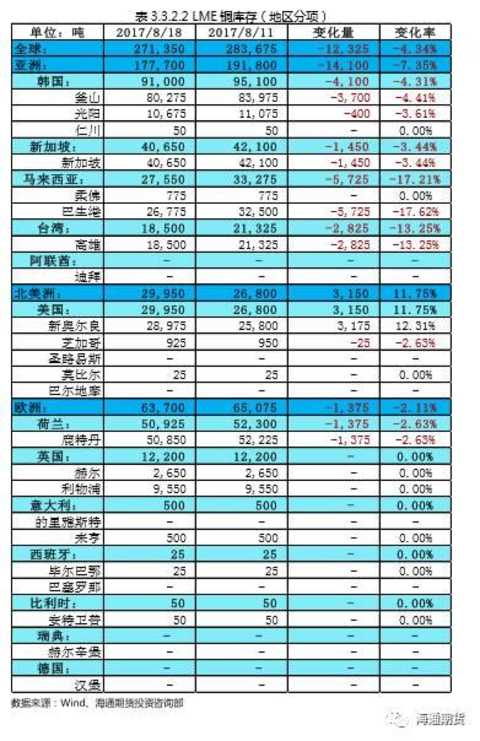

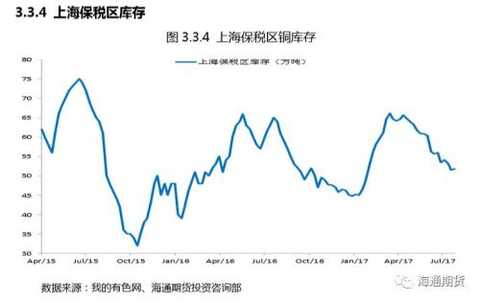

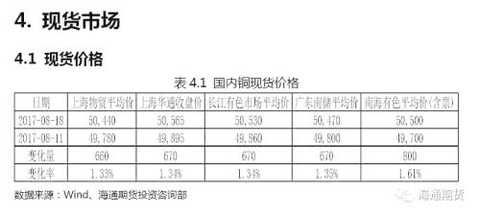

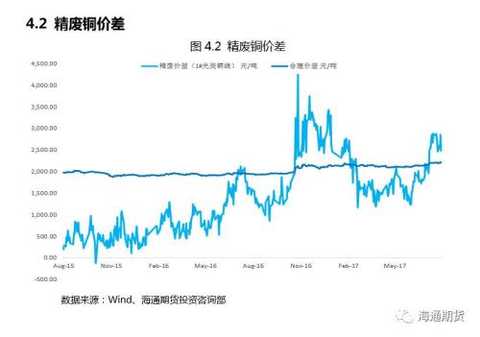

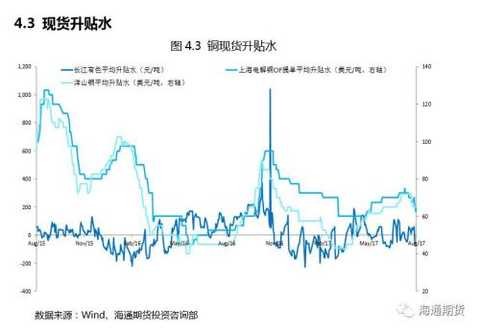

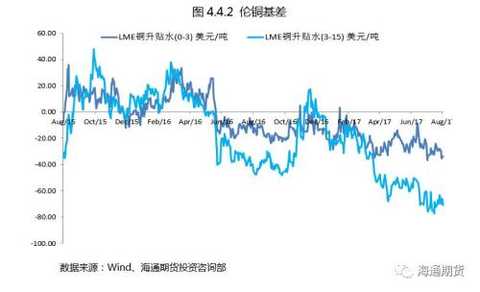

Investment points ◆Market review This week, the closing price of the Shanghai-China copper March contract rose from last Friday. The Shanghai copper three-day closing price rose by 1,320 yuan to 51,420 yuan/ton, or 2.63%. The price of the three copper prices rose by 54 US dollars to 6,481 US dollars / ton, an increase of 0.84%. This week, the price of copper showed a trend of first and foremost. In the first half of the week, due to lower-than-expected data such as domestic industrial added value, total retail sales of social consumer goods and fixed assets investment, copper prices showed a certain decline on Monday night. However, with the restrictions on importing North Korean lead ore, as well as the contraction of zinc supply and the continued decline in inventories announced on Monday, the stacking agency is based on the recent weak US economic data betting on the Dow's dovish speech at 2 am on Wednesday to do more non-ferrous metals. Copper on Tuesday nights rose more with zinc and lead, and the second half of the week oscillated. On the macro level, domestic industrial added value, total retail sales of social consumer goods, and fixed asset investment in July were less than expected. This week's funding is tight; US retail sales in July exceeded expectations, prompting the US dollar index to return to the 94 psychological barrier, but the Fed In July, the dovish of the meeting was full, and the asset price was too high. The Eurozone's GDP grew by 0.6% in the second quarter, and the economy recovered steadily. The ECB stated that the monetary policy stance will remain generally neutral between 2017 and 2019. In terms of industry, BHP Billiton will inject $2.5 billion to extend the life of Spence copper; Peru urgently lifts Las Bambas road blockade MMG to resume normal shipments; WBMS report: January-June 2017 global copper market supply shortage 41,000 tons; Bureau of Statistics: China Refined copper production in July increased by 1.5% year-on-year to 733,000 tons; flooding of the Grasberg copper mine power and water supply will be interrupted but mining will continue as usual; Glencore shut down its Zambia copper-cobalt project due to power supplier cuts in electricity supply. In terms of funds, the net holdings of LME Copper Management Fund increased slightly by 2.48% in the week of August 11th, short positions opened 616 lots, long positions opened 2,417 lots, overall bullish; August 15th report week, CFTC non-commercial Net positions rose sharply, up 11.14%, for six consecutive weeks, non-commercial long positions opened 6,182 lots, and short positions opened 2,489 lots, overall bullish. This week's holdings increased slightly by 2.22%, and the volume decreased by 26.77%. In terms of inventory, global dominant inventories fell by 1.99% this week, with LME inventories falling by 12,325 tons, a decrease of 4.34%, SHFE inventories falling by 3,687, a decrease of 1.77%, and COMEX inventories rising by 3,032 tons, or 1.90%. In the last period, the stocks in the previous period ended three consecutive increases, and the inventory in Shanghai began to decline. In terms of spot, the price difference of refined copper has increased by 0.72% compared with last week. The replacement effect of scrap copper continues. According to the survey data of Nanchu Business Network, the price of scrap copper rods in Guangdong has risen sharply this week, and downstream cable factories are still willing to purchase. The scrap copper rod was 9.23% last Friday. Due to the infringement action of the tax bureau, the ticket points continued to rise this week. The Yangshan copper premium and the Shanghai electrolytic copper CIF bill of lading averaged lower than last week. The demand for imported copper market has weakened; the Yangtze River non-ferrous average premiums and discounts were all below 0, indicating that demand has weakened, and closed at 60 yuan/ton on Friday. The Shanghai copper base gap was 270.83% larger than last week. Lun copper premium water (0-3) expanded 20.54% from last week. ◆ Investment advice Next week, we will focus on US new home sales, existing home sales, Markit manufacturing PMI, initial jobless numbers, and durable goods orders. This week's price increase is mainly affected by market sentiment. It is expected that the relevant US economic data may not be as expected, continue to bearish the dollar, the US dollar index or double bottom, Lido metal; from the disk point of view, the trend of zinc is still strong, or drive the copper price further upward, Therefore, the price of copper is bullish. On a technical level, Shanghai copper has been supported at a position of 50,000 yuan/ton (Bronze price of US$6,300/ton). Macro news 1. The capital is “drought†The market is eager to drop the “Ganlin†SMM News: Since the beginning of this week, the market funds have been bleak: interest rates on Shibor, interbank pledged repo When the prices of various varieties are all in line, the supply and demand of funds are seriously deviated; in the trading market, non-bank institutions can't afford to borrow money, and the top of the farmer's bank is difficult to borrow, and the big bank is not willing to bleed. According to brokerage China, although Yang Ma has already dropped 230 billion in the past two days, even yesterday's single-day net launch hit a three-week high, but this has not alleviated the exhaustion of market liquidity. There have even been rare rumors of institutional defaults in the market. In fact, since this week, the funds have been extremely tight, and R007 has risen 68BP in the last three days to reach a high of 3.89. According to brokers China cited industry traders, brokers and funds have reached the point where they can't borrow money. 2. ECB: Monetary policy stance is expected to remain generally neutral between 2017 and 2019 On August 17th, the European Central Bank announced the minutes of the July monetary policy meeting. The minutes of the meeting showed the European Central Bank’s monetary policy. The field is expected to remain generally neutral between 2017 and 2019. The ECB believes that asset purchases will remain an important monetary policy tool, and the degree of monetary easing is determined by all tools; the economic growth prospects are getting better and believe that the inflation rate will move closer to the target level. The core inflation rate is initially showing signs of acceleration, but there is still tangible evidence of rising inflation. At the same time, some members expressed concerns about the excessive risk of the euro, saying that the rise in the euro partly reflected changes in the fundamentals of the euro zone. After the announcement of the minutes, the euro fell sharply against the dollar, fell to a new low since August, and immediately regained the decline and began to rebound. 3. Eurozone second quarter GDP growth of 0.6%, steady economic recovery SMM News: On August 16, Eurostat announced the second quarter GDP revision of the Eurozone. After the revision, the Eurozone's GDP in the second quarter increased by 0.6% from the previous quarter, which was the same as expected. In the quarter, the GDP of the 28 EU countries increased by 0.6%. The Eurozone and EU 28 countries' second quarter GDP revisions were both higher than the first quarter's data of 0.5%. In addition, after the revision, the Eurozone's GDP in the second quarter increased by 2.2% year-on-year, slightly better than the expected 2.1%. The revised GDP of the 28 EU countries in the quarter increased by 2.3% year-on-year, better than the previous quarter. As of the second quarter of this year, the euro zone economy has continued to expand for 17 quarters. 4. Summary of the Fed's July meeting: There are obvious differences in the path of interest rate hikes. Most people agree to announce the contraction at the next meeting. SMM News: The minutes of the Fed's July FOMC monetary policy meeting showed that Fed officials expressed their views on this year's opening contraction, but they have different views on whether inflation will continue to weaken, leading to the existence of a path to raise interest rates again before the end of the year. Disagreement. The vast majority of Fed officials are expected to announce a downsizing at the next meeting (upcoming), many of whom believe that they will shrink in a relatively modest manner. The Fed announced its contraction plan at the FOMC meeting in June, and announced a “relatively rapid†start-up of the contract at the July meeting, which is expected to be announced in September and then implemented on October 1. It is worth noting that the minutes of the July meeting showed that Fed officials have serious differences on the path of interest rate hike this year. Some Fed officials believe that the current inflation level cannot support interest rate hikes, and that inflation risks may be biased. It is recommended that “the Fed can have more patience†and wait until the inflation is on track before proceeding to the next step. The minutes of the meeting showed that Fed officials had different opinions on whether the monetary easing policy caused the stock price to be high. Most policy makers pointed out that the continued rise in US stock prices has eased the financial situation after the financial crisis, and high stock prices may not pose a greater risk to financial stability. But officials at the meeting also acknowledged that market volatility is low and that investors are over-concentrated in certain asset classes and should be noted. The Fed believes that current asset prices have been upgraded from "notable" to "elevated", and some officials worry that long-term yields are low, leaving investors over-exposure to risk. 5. US retail sales are better than expected to create the largest increase since December 2016 SMM News: On August 15, the US announced July retail sales data, the largest increase since December 2016, marking a strong start to the US consumer spending in the third quarter. US retail sales in July increased by 0.6% quarter-on-quarter, better than the expected 0.3%, indicating improved employment data, limited inflation, and lower borrowing costs are increasing purchasing power. At the same time, the retail Sales data for the previous two months was also corrected to positive. So far, the US retail Sales ring data has been non-negative for five consecutive months. In addition, retail sales in July increased by 4.2% year-on-year. In terms of classification, car dealerships and non-storefront retail sales recorded the largest growth for the whole year, while online shopping retail Sales was also boosted by the event day of large e-commerce websites. After the release of the data, the US dollar index quickly rose, breaking through 94. Spot gold quickly fell, falling below the $1,270/oz mark and falling about 1% in the day. The 10-year US Treasury yields rose rapidly, rising to a high of 2.278%, and the day's cumulative increase was about 6 basis points. S&P 500 index futures also expanded their gains. 6. US new housing starts and construction permit data is less than expected In the United States, the annualized total number of new housing starts in July was 1.155 million, which was less than the expected 1.22 million. The monthly rate of new housing starts in July was 4.8% lower than the previous month, which was significantly lower than the expected growth rate. The total number of building permits in July was also less than expected, with a published value of 1.223 million. According to the analysis, the US housing construction industry unexpectedly fell back in July, and both single and composite residential buildings declined, which caused the market to cool down the US housing market in the third quarter. Despite strong demand in the property market, given the shortage of skilled workers and tight supply of land, the fall in data means that it is more difficult for builders to regain their growth momentum. Trade disputes between the United States and Canada have also led to an increase in material costs. After the data was released, the US dollar fell slightly. 7. China's urban fixed asset investment and private investment growth rate both fell from January to July SMM News: According to statistics released today by the Bureau of Statistics, China's urban fixed asset investment in January-July fell back to 8.3% year-on-year, which was the lowest in the year. The year-on-year growth rate of 8.3% was 0.3 percentage points lower than that of the previous month, and it was less than the expected 8.6%, but it was 0.2 percentage points higher than the same period of the previous year. From the perspective of the ring rate, urban fixed asset investment in July increased by 0.61% compared with June. The growth rate of private investment also slowed down to 6.9%. The proportion of private fixed assets investment in national fixed asset investment (excluding rural households) was 60.7%, which was the same as that in January-June. The Bureau of Statistics pointed out that fixed asset investment grew steadily and infrastructure construction continued to strengthen. Infrastructure investment growth remained strong from January to July, up 20.9% year-on-year, but the growth rate dropped 0.2 percentage points from January to June. 8. China's total retail sales of consumer goods in July fell by less than expected SMM News: China's total retail sales of consumer goods in July was 10.4% year-on-year, less than expected 10.8%. In July 2017, the total retail sales of consumer goods reached 296 billion yuan, a nominal increase of 10.4% year-on-year (the actual increase of 9.6% after deducting the price factor, the following nominal growth except for special instructions). Among them, the retail sales of consumer goods above designated size was 1281.3 billion yuan, an increase of 8.6%. From January to July 2017, the total retail sales of consumer goods reached 201.978 billion yuan, a year-on-year increase of 10.4%. Among them, the retail sales of consumer goods above designated size was 890.21 billion yuan, an increase of 8.7%. 9. China's industrial added value growth slowed to 6.4% in July SMM News: The National Bureau of Statistics announced today that China’s industrial added value above designated size in July was 6.4%, expected 7.1%, the previous value of 7.6%. China's industrial added value of above-scale industries from January to July was 6.8% year-on-year, with an expected 6.9% and a previous value of 6.9%. In terms of industries, in July, 37 of the 41 major industries maintained an increase in value added. Among them, the agricultural and sideline food processing industry increased by 6.0%, the textile industry increased by 4.3%, the chemical raw materials and chemical products manufacturing industry increased by 2.3%, the non-metallic mineral products industry increased by 3.4%, the ferrous metal smelting and rolling processing industry increased by 2.1%, non-ferrous metals. Smelting and rolling processing industry increased by 1.1%, general equipment manufacturing industry increased by 11.5%, special equipment manufacturing industry increased by 11.9%, automobile manufacturing industry increased by 11.8%, railway, shipbuilding, aerospace and other transportation equipment manufacturing increased by 3.3%, electrical machinery The equipment manufacturing industry grew by 11.7%, the computer, communications and other electronic equipment manufacturing industries grew by 11.8%, and the power, heat production and supply industries grew by 9.7%. 2. Industry news 1. BHP Billiton will note $2.5 billion to extend the life of Spence Copper SMM August 18th: On August 17, mining giant BHP Billiton (BHP) announced that it will spend $2.46 billion to extend the life of the Spence copper mine in northern Chile for more than 50 years. Strong demand is expected and supply is tightening, and copper prices have now hit the highest level since the end of 2014. Earlier spending due to the fall in the price of 2015-2016 led to a decrease in spending on the industry. In the face of pressure from activist fund Elliott to provide greater returns to shareholders, BHP Billiton announced that copper is a key priority for the company, as copper is widely used in the wire and automotive sectors and is expected to remain long-term Demand. Although iron ore remains the main profitable product of BHP Billiton, copper earnings are expected to account for approximately 19% of its basic earnings for the year ending June. Copper prices have been rising in the past few months, and strong demand from China has pushed copper prices up 18% so far this year. BHP Billiton will begin expansion of the Spence copper mine next year and it is expected that the project will be completed in 2021. 2. Peru urgently lifts Las Bambas road blockade MMG to resume normal shipment SMM, August 18: China Minmetals Corporation (MMG) resumed shipments of its Las Bambas copper mine in Peru after the Peruvian government announced an emergency measures to end the road blockade of local communities. Minmetals said on Thursday that traffic along the way has returned to normal. Prior to this, the government implemented a 30-day emergency measure in three areas near the Andes mine in southern Peru. In a separate statement issued earlier Thursday, Minmetals said community residents in the Mara district blocked the Las Bambas road for a week and asked the company to compensate for land use on locally built roads. Emergency safety measures will allow dialogue to resume between companies, governments and communities, and the company added that copper production has not been affected. In April of this year, Minmetals reached an agreement with landowners in neighboring areas as regional residents blocked the use of other mining operations in the area. A conflict in October last year resulted in the death of one man and the injury of 20 policemen. 3.WBMS Report: The global copper market supply shortage of 41,000 tons from January to June 2017 According to foreign news on August 16th, the World Bureau of Metal Statistics (WBMS) released a report on Wednesday that from January to June 2017, the global copper market supply shortage of 41,000 tons, 2016 annual supply shortage of 68,000 tons. Inventories fell during the June period, and stocks as of the end of June were 71,000 tons higher than at the end of December 2016. From January to June this year, global copper mine production was 10.1 million tons, a decrease of 0.1% from the same period last year. From January to June, global refined copper production was 11.67 million tons, an increase of 1.6% over the same period of last year. Among them, China's copper production increased significantly, with an increase of 329,000 tons. Chile's copper production decreased significantly, down 168,000 tons. Copper consumption in January-June was 11.71 million tons, compared with 11.88 million tons in the same period last year. From January to June, China's apparent consumption decreased by 271,000 tons to 5.569 million tons, accounting for more than 48% of global demand. From January to June, the EU's 28 countries' copper output increased by 8%, and the demand was 1.715 million tons, down 3.1% from the same period last year. In June 2017, global refined copper production was 2.0166 million tons and consumption was 201.34 million tons. 4. Bureau of Statistics: China's refined copper output in July increased by 1.5% year-on-year to 733,000 tons According to Beijing August 16 news, the National Bureau of Statistics released data on Wednesday showed that China refined copper production in July The volume increased by 1.5% year-on-year to 733,000 tons. The data also showed that China's lead production in July increased by 5.6% year-on-year to 432,000 tons; July zinc production decreased by 6.3% year-on-year to 476,000 tons. 5. Flood outbreaks Grasberg copper mine power and water supply will be interrupted but mining will continue as usual SMM information: According to a staff member of the local trade union, after a few weeks of heavy rain, freedom A small town near the Freeport-McMoRan Grasberg copper mine suffered a severe landslide. The labor relations personnel of the Freeport Indonesia branch, Puti Fe, confirmed this by calling from Papua. It also indicates that the flood caused a 68-mile landslide in the town of Tembaga Pura. In addition, unfortunately, the diesel tank of the power plant caught fire after being hit by the rock, thus causing a regional power outage. A worker is currently missing and mining operations are carried out as usual, but electricity and water supply are expected to be interrupted in the next few days. Riza Pratama, spokesperson for the Freeport Indonesia branch, also confirmed the outbreak of the flood by means of a short message and said that the company is actively collecting more information. 6. Glencore closes its Zambia copper-cobalt project due to power supplier's reduction of power supply SMM News: Glencore closed its Zambia copper-cobalt project on Monday as power suppliers cut their power supply. This has also triggered fears that a large copper mine in the second largest copper producer in Africa may be shut down. The country's power supplier CoPP erbelt Energy said it will continue to supply electricity to miners only after the miners agree to pay a 55% increase in electricity prices since April. Electricity supply issues could lead to the closure of the country's third-largest copper smelter. The Zambian Mining Union, which represents the interests of the miners, said that a sharp increase in electricity prices would jeopardize the survival of the country’s miners, as copper prices remained sluggish and power supply tensions appeared from time to time. Glencore's copper production in Zambia accounts for a quarter of the country's total copper production. Mopani Copper Mines Plc said its Kitwe and Mofulira projects will resume production once the electricity price dispute with the electricity supplier is resolved. Zambia is currently one of the top ten copper producers in the world. This week, the closing price of the Shanghai-China copper March contract rose from last Friday. The Shanghai copper three-day closing price rose by 1,320 yuan to 51,420 yuan/ton, or 2.63%. The price of the three copper prices rose by 54 US dollars to 6,481 US dollars / ton, an increase of 0.84%. This week, the price of copper showed a trend of first and foremost. In the first half of the week, due to lower-than-expected data such as domestic industrial added value, total retail sales of social consumer goods and fixed assets investment, copper prices showed a certain decline on Monday night. However, with the restrictions on importing North Korean lead ore, as well as the contraction of zinc supply and the continued decline in inventories announced on Monday, the stacking agency is based on the recent weak US economic data betting on the Dow's dovish speech at 2 am on Wednesday to do more non-ferrous metals. Copper on Tuesday nights rose more with zinc and lead, and the second half of the week oscillated. On Friday, the ratio of the Hulun in March was 1.19, which was higher than that of last Friday. It shows that the Shanghai copper trend was slightly stronger than that of the copper after the exchange rate factor was removed. On Friday, the copper and copper import profit and loss range recorded -673.52 yuan / ton to -575.43 yuan / ton on Friday, the absolute value has shrunk from last Friday, still below the break-even line, the import window is still closed. In terms of spot, this week, the Shanghai copper 1709 contract was completed, and the premium was adjusted to follow the basis change. The overnight spread before the delivery was around 130 yuan/ton, and the spot quickly rose to 20 yuan/ton-liter-liter of 90 yuan/ton. After returning to the moon, it will return to the discounted water. The proportion of good copper is small. The discounted one hundred yuan is still attractive. The transaction is still good. The downstream is high, and the stock is stable when the callback is maintained. The spot is stable at 140-90 yuan/ton. (Shanghai Nonferrous Network) 5. Risk warning Macroeconomic indicators at home and abroad exceeded expectations.

For baby, especially for girls, parents sometime try to dress their baby in princess. So many accessories are being used, such as headbands. There are many styles baby headbands for choice. It is well matched with dress and cute rompers. Also the materials is different. Cotton is always better option for baby.

Baby Headbands:

kids headbands,baby hair accessories,baby bowtique Shenzhen Baby Happy Industrial Co.,Ltd , https://www.bbabyshoes.com